Beyond Physical and Digital: Why the Future of Tax Stamps is Phygital

Why tax authorities are adopting phygital solutions to strengthen revenue protection and market transparency.

Why tax authorities are adopting phygital solutions to strengthen revenue protection and market transparency.

Every year, around 118 billion tax stamps are used on cigarettes and alcoholic drinks across 90+ countries – serving not only as a tax collection tool but also as a key element in excisable goods management programs that enable product authentication and traceability to protect consumers and government revenue.

The number of countries adopting tax stamp regimes continues to grow, with new applications emerging across various sectors, including mineral water, soft drinks, beer, pharmaceuticals, and cement. At the same time, rising illicit trade and evolving market expectations are driving the next major transformation: the convergence of physical and digital security technologies in the world of tax stamps.

This fusion, known as phygital, is transforming how governments safeguard products, revenues, and consumer trust. As counterfeiting techniques evolve and market expectations shift, traditional tax stamps also need to develop.

Governments are redefining tax stamps to integrate digital innovations alongside traditional physical features, recognizing that physical protection alone can no longer keep pace with sophisticated counterfeiting or the new market demands.

What’s Driving the Change

Increase in illicit tradeIllicit activities continue to rise, posing significant risks to citizens and economies worldwide. From tobacco smuggling and counterfeiting in the EU to methanol poisoning from counterfeit liquors in Brazil and the proliferation of fake medicines globally, these cases illustrate the serious and growing threat of illicit trade. |

|

Consumers are becoming a critical part of illicit product detectionAuthorities increasingly recognize that consumers play an essential role in supporting customs and law enforcement efforts, serving as an additional line of defense against illicit trade. As a result, tax stamp and traceability programs now invite consumers to verify product authenticity by scanning unique identifiers. |

|

Governments seek control and insight, and AI is playing a key roleThe growing use of data collection and artificial intelligence (AI) is transforming how authorities monitor excise goods and detect irregularities. By analyzing large volumes of production and distribution data, AI-powered systems can identify anomalies, predict illicit activities, and support evidence-based decision-making for more effective enforcement and policy planning. |

|

Sustainability mattersReducing physical components, such as adhesives and magnetic inks, helps preserve recyclability and aligns with environmental goals. |

|

Inclusion through innovationTax stamp designs should consider the needs of citizens with visual impairments. Integrating digital technologies can enhance accessibility and make product authentication more inclusive for all users. |

Why Governments are Going Phygital

These converging trends explain why governments are turning toward phygital tax stamps.

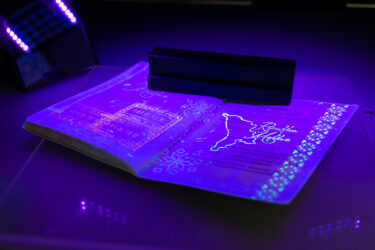

Traditional tax stamps - enhanced with inks, holograms, and optical variable devices - have long played a crucial role in revenue protection.

They provide immediate proof of authenticity, allowing inspectors and citizens to verify products without specialized tools or connectivity. These features also act as a deterrent to counterfeiters, increasing the cost and complexity of falsification. However, as counterfeit methods grow more sophisticated and markets evolve, physical measures alone are no longer sufficient.

Digital technologies now make it possible to enhance, not replace, physical security by:

- Adding multiple layers of authentication

- Enabling track and trace and real-time production monitoring

- Making verification faster, stronger, and harder to bypass

Digital Technologies as a Layer of Defense

Just like a physical stamp, a code printed directly on a product can be counterfeited or copied if not properly protected. That’s why protecting the code is crucial.

Advanced digital technologies enable the authentication of these codes, ensuring instant product verification and reinforcing the integrity of the entire system. As data carriers, such as QR codes, increasingly serve as gateways to product information and regulatory compliance, security must remain central to policy design – protecting consumers and markets from the risks of illicit trade.

Phygital is the future of tax stamps

At EDGYN, we believe the future lies in the seamless combination of physical and digital technologies, making products connected, intelligent, and secure. With over two decades of experience, EDGYN supports governments worldwide in this transformation – combining our proven expertise in physical security and digital innovation to protect revenues, enhance transparency, and build trust.

Physical security components – visible and trusted by consumers – remain essential, especially in government markets. But when complemented by digital technologies, tax stamps gain new capabilities: enhanced traceability, real-time access to information and enriched data, instant authentication, and greater adaptability to evolving threats.

Contact our expert to learn more.

EDGYN is your trusted partner in combining physical security and digital technology to help governments protect revenues, ensure compliance, and strengthen public trust.